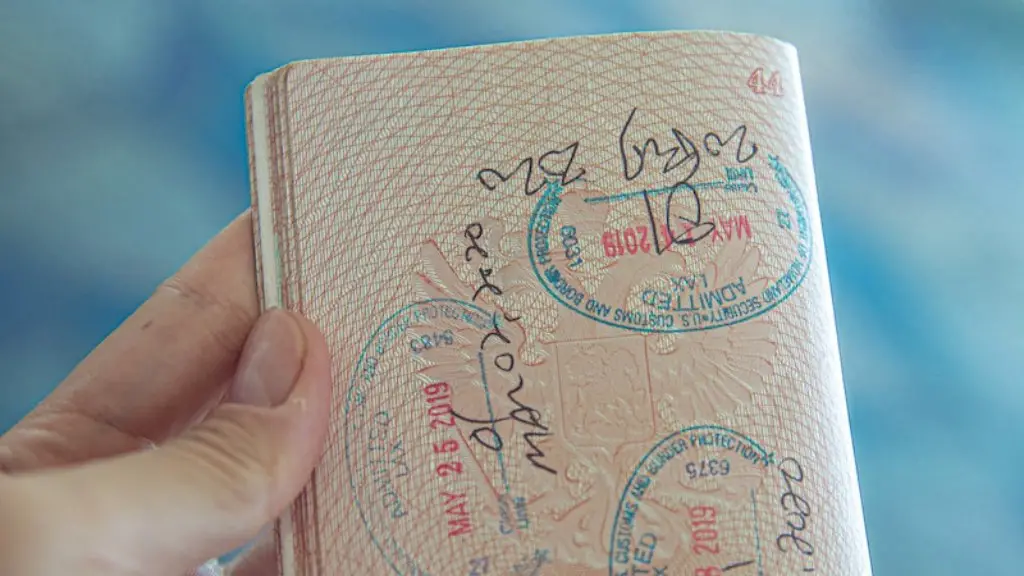

Sure! You can – and should – take out travel insurance when you are abroad. This type of insurance will protect you in the event of an emergency, like if you need to be medically evacuated or if your luggage is lost or stolen. It’s always better to be safe than sorry, so make sure you’re covered before you head out on your next international adventure.

Yes, you can definitely take out travel insurance when you are abroad! This will protect you in the event that something happens and you need to cancel your trip or return home early.

Can I get travel insurance while already abroad?

If you have a pre-existing condition and are already overseas, you may still be able to purchase travel insurance. However, you will not be able to make any claims for an incident related to your pre-existing condition. You can still have coverage for other emergency medical expenses unrelated to your conditions, as well as all other events listed in your policy.

There are a few things to keep in mind when purchasing travel insurance. Some companies will only offer insurance if you purchase it before leaving for the airport. Others will let you buy insurance while you’re at the airport or even waiting at your gate. Some, instead, won’t insure you if you’ve already left home on your way to the airport. It’s important to read the fine print and understand the coverage you’re getting before purchasing any insurance policy.

Can I extend travel insurance while abroad

If you need to extend your travel insurance policy overseas, contact your insurer as soon as possible. Review your policy documents carefully before taking action. With these tips in mind, you’ll be able to extend your travel insurance policy without any problems so you can enjoy your trip stress-free.

If you don’t have travel insurance and something goes wrong while you’re away, you’ll have to pay for it yourself. This could cost you a lot of money, especially if you have to cancel your trip and don’t get your money back.

What travel insurance will not cover?

This is an important thing to remember when travelling – most travel insurance policies will not cover you if you have an accident or have your property stolen while you are under the influence of drugs or alcohol. Make sure you are aware of your policy’s restrictions and limitations before you travel, and be sure to stay safe and sober while you are away!

Most travel policies will typically limit the length of any one trip to around 30 days. If you are planning a longer trip, you may need to purchase long-stay travel insurance (sometimes called backpacker insurance). Be sure to check with your insurance provider to see what their policies cover.

What happens if you fall ill abroad?

Your insurance policy should have given you an international number that you can use to get in touch with your insurers. Your call will usually be dealt with by an assistance company which is appointed by the insurer to arrange the necessary medical treatment.

It’s important to get travel insurance as soon as you book your holiday, in case you need to cancel your trip. Travel insurance will cover you if you get injured or fall ill and can’t travel.

Who is the best travel insurance company

There are a lot of factors to consider when choosing the best medical coverage for your needs. If you are looking for the best coverage, GeoBlue is a great choice. They offer a variety of plans to meet your needs and budget. Travelex, Allianz Travel Insurance, and InsureMyTrip are also great options for medical coverage.

Travel insurance is insurance that is intended to cover medical expenses, trip cancellation, lost luggage, flight accident and other losses incurred while traveling, either internationally or within one’s own country.

There are different types of travel insurance, and the type of coverage you need will depend on the type of trip you are taking. For example, if you are going on a short business trip, you may not need the same level of coverage as someone who is taking a leisure trip or going on a safari.

Here are the three main types of travel insurance coverage:

1. Medical insurance: This type of insurance will cover your medical expenses if you become sick or injured while on your trip. It is important to note that this coverage is usually limited to a certain amount, and it will not cover repatriation costs (the costs of getting you back to your home country).

2. Cancellation/interruption insurance: This type of insurance will reimburse you for non-refundable trip expenses if you have to cancel or interrupt your trip for a covered reason, such as a sickness or injury.

3. Luggage insurance: This type of insurance will reimburse you for lost, stolen, or damaged luggage. It is important to note

Can I get a full refund with travel insurance?

Trip cancellation insurance is a great way to protect your investment in a trip. If you have to cancel for a covered reason, you can get a full refund of your prepaid, non-refundable expenses. This coverage is typically included in comprehensive travel insurance policies. Be sure to read the policy carefully to understand what is covered and what is not.

It’s always a good idea to have travel insurance, even if you think you don’t need it. You never know what might happen on your trip, and it’s better to be safe than sorry.

What is a reasonable amount to pay for travel insurance

Travel insurance is a great way to protect yourself and your family while traveling. It can cost anywhere between $2 and $6 a day depending on your age, travel destination, cover level and if you have any pre-existing health conditions. Be sure to shop around and compare rates before purchasing a policy to get the best coverage for your needs.

The comprehensive policy is a great option for those who want to be covered for a variety of potential problems while traveling. The policy usually covers delays, cancellation due to sickness or death, lost luggage and some emergency medical costs. This can give you a great peace of mind while traveling, knowing that you are covered in case of any problems.

What is the average cost of travel medical insurance?

There are several factors that can affect the cost of travel medical insurance. The type of coverage you select, the length of your trip, your age, and your destination can all play a role in determining the price you’ll pay for your policy. In general, you can expect to pay anywhere from $1 to $5 per day for an essential travel medical insurance plan.

If you are sick while traveling in the US, the best thing to do is to contact the nearest US Embassy or Consulate. They can provide you with a list of local healthcare providers and medical facilities. If your illness is serious, consular officers can help you find medical assistance, and, if you desire, inform your family and/or friends.

Final Words

Yes, you can purchase travel insurance while you are already abroad. This is sometimes called needing “post-departure” coverage.

When traveling abroad, it is always a wise idea to purchase travel insurance. This insurance can protect you in the event of an accident, illness, or theft. Many travel insurance policies will also cover you in the event that you need to cancel your trip.