You can’t always predict what will happen on your trip, but you can be prepared for the unexpected with travel insurance. Travel insurance can protect you from lost baggage, flight delays, and even cancellation. If you’re thinking about buying travel insurance, here’s what you need to know.

No, you cannot add travel insurance after booking with Delta. You must purchase travel insurance at the time of booking in order to be covered.

Can I add trip insurance after I book Delta?

You can buy travel insurance at any time before your trip. However, the best time to buy it is when you book your trip, because you’ll be covered for any cancellations or other problems that might occur before the trip. If you wait until you’re already on the trip, you might not be able to get coverage for some things, like cancellations. So it’s best to buy travel insurance as soon as you book your trip.

It’s always best to purchase travel insurance as early in the process as possible. If you wait until after you’ve booked your trip, you may miss out on certain benefits.

Is it too late to add travel insurance

There is no definitive answer to this question as it depends on the individual insurer’s policies. In general, you can buy coverage any time before the date of your trip. That said, it’s always best to buy coverage as soon as you make your reservations. This way, you can be sure that you’re covered in case of any unforeseen circumstances that might arise.

If you’re looking for comprehensive travel insurance, we recommend using a provider other than Allianz. Allianz Travel Insurance is sold by many airlines, but the coverage is often quite weak. For example, Allianz doesn’t cover any trip delays, cancellations, or interruptions unless they’re caused by a covered event like severe weather.

Can you get travel insurance for a trip already booked?

Travel insurance is a must-have when booking a holiday. It protects you in case you have to cancel your trip due to injury or illness.

Travel insurance can be a great way to protect your investment in a non-refundable flight. If your flight is canceled, you may be able to recoup your losses through your travel insurance policy. Be sure to check the details of your policy, as there may be some restrictions on coverage.

When should I buy trip cancellation insurance?

There are many reasons to purchase travel insurance as soon as you book your trip or holiday. For instance, many travel insurance policies include trip cancellation benefits which can help you recover any non-refundable trip costs if you have to cancel your travel plans due to a covered reason. This can give you peace of mind and help you avoid financial losses in the event that you have to cancel your trip.

When deciding whether or not to purchase travel insurance, you should consider the cost of the insurance policy in relation to the total cost of your trip. In general, you should expect to pay anywhere from 4%-10% of your trip cost for insurance. For example, if your trip costs $5,000, you can expect to pay $250-$500 for an insurance policy. The price of the policy will depend on the specific coverage you choose and the length of your trip.

Do I need to buy travel insurance before flight

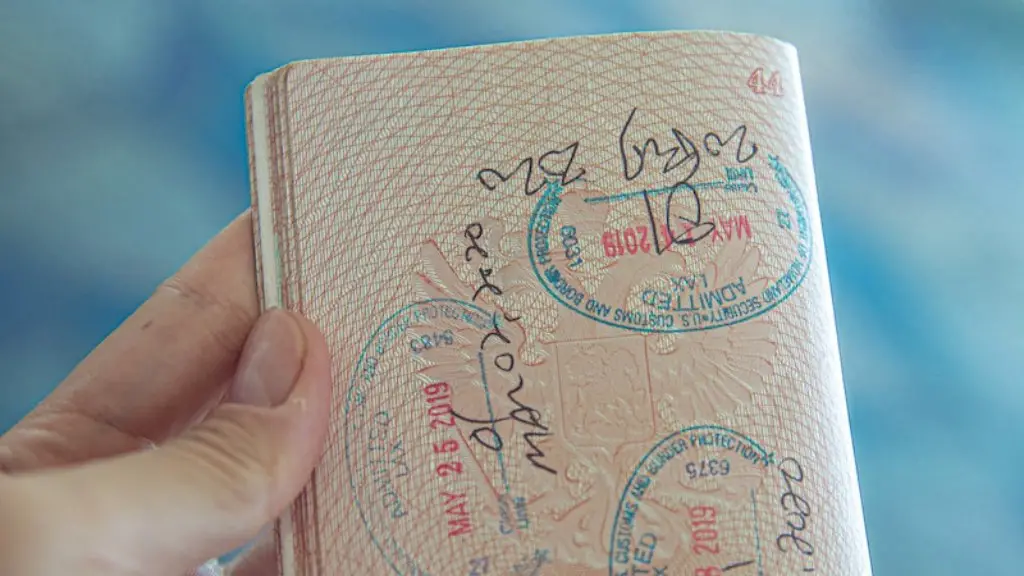

If you’re travelling overseas, travel insurance is just as important as a passport. Without it, you or your family could suffer financially if things go wrong. No matter who you are, where you’re going and what you’re doing, get insurance. Some international travel insurance policy providers may cover COVID-19-related claims.

Travel insurance is one of those things that you hope you never have to use, but it’s there for peace of mind in case something goes wrong. Unlike other aspects of your travel experience like airfares or hotel-room rates, the price of travel insurance doesn’t increase the closer you get to your travel date. There’s no financial penalty if you wait to buy travel insurance (except for those bonus coverages, of course).

What date should you put on travel insurance?

When you are looking at annual multi-trip insurance, thestart date is important to consider. This is the date that yourcoverage will begin, and if you have already booked a trip,you will need the insurance to start right away in order to beprotected in case of cancellation. Trip duration is also animportant factor to consider when choosing your insurance plan- you’ll want to make sure that you have enough coverage for theentire length of your trip.

It’s important to be aware that Travelers does not have a grace period for making payments on your policy unless it is required by state law. This means that if you miss a payment, your policy could be immediately cancelled. Be sure to stay up to date on your payments to avoid any unwanted surprises.

What is usually covered by travel insurance

A comprehensive travel insurance policy can help protect you from a number of potential problems while you’re traveling. It usually covers delays, cancellations due to sickness or death, lost luggage, and some emergency medical costs. Having this type of insurance can give you peace of mind and help you enjoy your trip knowing that you’re covered in case of any unforeseen problems.

Though it may seem like an extra expense, travel insurance is often worth the investment for its potential to help reimburse you for hundreds of thousands of dollars of covered travel-related expenses like emergency evacuation, medical bills, and costs related to trip cancellation and interruption. If you have to cancel your trip due to an unforeseen circumstance, or you experience an emergency while you’re traveling, having travel insurance can save you a lot of money and stress.

What is risk free cancellation Delta?

Dear Customer,

Thank you for booking with us! We want to let you know that as part of our Customer Commitment, we offer Risk-Free Cancellation for customers who book direct on deltacom or the Fly Delta app. This means that after you’ve purchased a qualifying eTicket, you have up to 24 hours after booking to cancel it for any reason and receive a full refund with no fees. We hope you have a great trip!

It’s not too late to buy trip insurance! You can still buy insurance with trip cancellation benefits, even if you made your trip arrangements a long time ago. You should know, however, that losses related to pre-existing medical conditions won’t be covered.

Final Words

If you booked your ticket directly through Delta, you can add travel insurance within 21 days of your initial purchase. If you booked your ticket through a different site or travel agent, you will need to contact them directly to add insurance.

Based on the research, it seems that you can add travel insurance after booking delta. However, it is always best to check with the company to be sure.