Whether you’re taking a leisurely cruise around the Caribbean or an adventurous expedition through Alaskan waters, cruise travel insurance can protect you from the unexpected. This type of insurance can cover everything from medical expenses and weather delays to misplaced luggage and cancelled cruises. Travel insurance is an important part of any vacation, and it’s especially important for cruises because of the added risks that come with travel by sea.

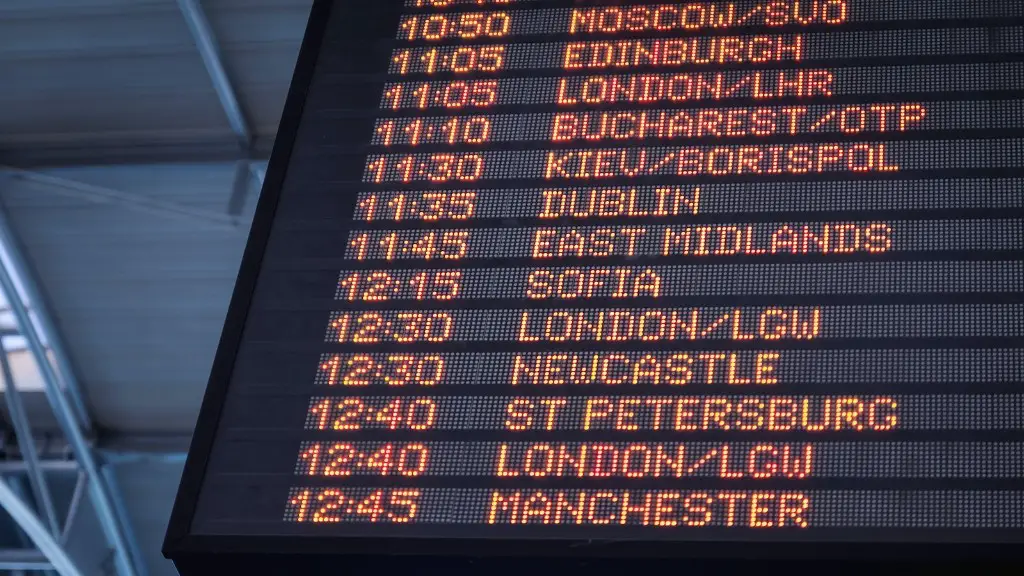

There is no definitive answer to this question as it can vary depending on the specific policy and provider. However, in general, cruise travel insurance is designed to protect travelers in the event of any unforeseen circumstances that may occur during their trip, such as missed connections, lost luggage, or medical emergencies.

Is cruise insurance the same as travel insurance?

When deciding whether to purchase insurance for your cruise vacation, it is important to compare the coverage offered by the cruise operator with that of a travel insurance provider. In most cases, the insurance offered by the cruise operator will have fewer coverage options and may not provide as much protection as a travel insurance policy.

Most cruise insurance plans will cover medical emergencies, trip cancellation, trip interruption, medical evacuation, and lost, damaged, or stolen luggage. Some policies may also cover cruise-ship disablement and pre-existing conditions. It is important to check with your insurer to see what is covered under your policy.

Are cruises covered under travel insurance

It is important to note that normal travel insurance does not necessarily cover a cruise. To get cover for cruise-specific events like cabin confinement, emergency airlift to hospital, missed port and unused excursions, you’ll typically need to buy specialist cruise cover.

It’s always a good idea to buy insurance when you book your cruise, in case you have to cancel for any reason. If you buy it within two weeks of making your deposit, you may even be able to get some bonus coverages.

What if you get sick on a cruise?

If you indicate that you have been feeling sick, you will be pulled aside for a quick checkup. If the ship’s medical personnel determine that you’re feverish, contagious or otherwise ill, they have the authority to prevent you from boarding.

If you’re planning to travel and party hard, be sure to get travel insurance that will cover you in case of an accident or theft. Most policies won’t pay out if you’re under the influence of drugs or alcohol, so it’s important to read the fine print before you purchase a policy.

What is usually covered by travel insurance?

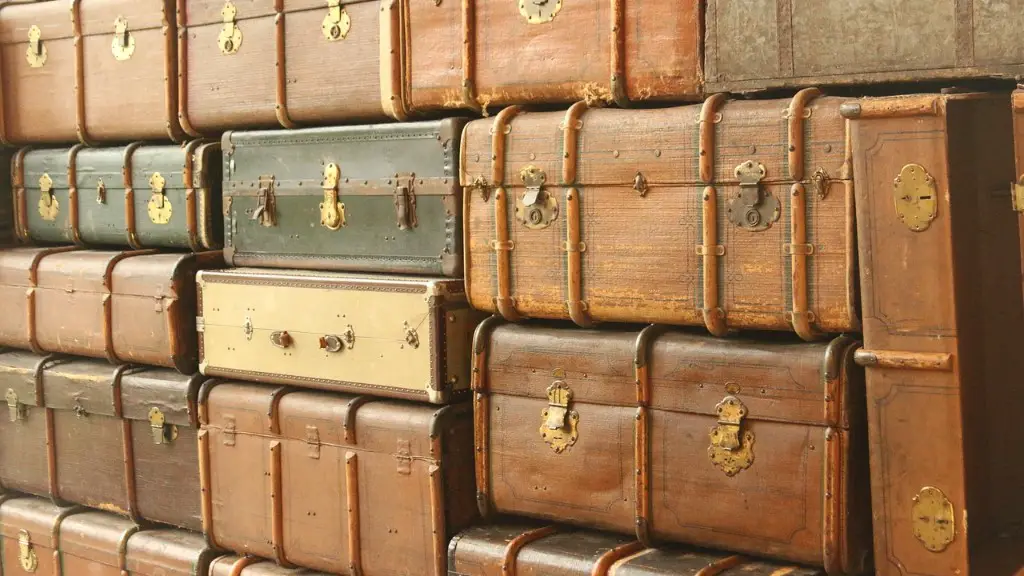

The comprehensive policy is a great option for those who want to be covered for a wide range of potential problems. The policy covers delays, cancellations due to sickness or death, lost luggage and some emergency medical costs. This can give you peace of mind when you are travelling, knowing that you are covered for a variety of potential problems.

It is important to attend the muster drill and to listen to the safety instructions. You should also drink alcohol responsibly, and buddy up with someone in case of an emergency. In-cabin safety is also important, and you should be aware of your surroundings at all times. If you are on your balcony, be sure to keep your safe door closed. Get to know your steward and don’t accept invitations to crew quarters unless you know the person well. Finally, don’t carry large amounts of cash with you, as this could attract unwanted attention.

Will my health insurance cover me on a cruise

Your regular health insurance likely won’t cover you if you have a medical emergency while on a cruise ship. Not even Medicare, which doesn’t cover health care services when the ship is more than 6 hours away from a US port. Serious medical emergencies may require a medical evacuation, which can mean being airlifted off the ship to the nearest hospital.

Cruise travel insurance is important because it can protect you from having to pay for non-refundable costs if you have to cancel your trip due to an unforeseen event. It can also protect you from lost baggage, medical emergencies, and more.

Why is cruise travel insurance so expensive?

Cruise holiday insurance claims are typically higher than claims for land-based holidays for a few reasons. First, there are extra costs associated with being ill on a ship, such as the cost of moving passengers to receive medical care onshore. Second, medical care on a cruise ship can be more expensive than on land. And finally, cruise ships typically travel to remote areas where medical care may be less readily available, making evacuation and treatment more costly.

A travel insurance policy can give you peace of mind on your vacation by protecting you from financial losses due to cancellations, delays, or other covered events. You can buy a policy directly from your cruise line when booking your trip, or through your travel agent (if you’re using one). Be sure to read the policy carefully so you know what is and is not covered.

What should cruise travel insurance cover

A standard travel insurance policy will cover lost and stolen belongings, trip cancellation, medical expenses and repatriation. However, there are extra levels of cover designed for cruise holidays which include cabin confinement cover, airlifts to hospital, missed ports and unused excursions.

Like many things in life, it’s always best to plan ahead when it comes to buying cruise insurance. By buying your policy as soon as you book your cruise, you’ll have the peace of mind of knowing that you’re covered in case of any unforeseen circumstances.

Is it too late to buy cruise insurance?

There is no definitive answer to this question as it depends on a number of factors. In general, you can buy coverage any time before the date of your trip. That said, it’s always best to buy coverage as soon as you make your reservations. This way, you can be sure that you’re covered in case of any unforeseen events that may occur before or during your trip.

If you have any symptoms of COVID-19 or test positive for the virus, the cruise ship may not allow you to board. If you are allowed to board, you may be required to isolate yourself from other passengers or take other precautions, depending on your symptoms and test results.

Conclusion

Cruise travel insurance is insurance that is designed to cover the costs associated with cruise travel. This type of insurance can cover the cost of medical expenses, trip cancellation, lost luggage, and other unexpected expenses.

A good cruise travel insurance policy will protect you financially if you have to cancel your cruise or if your cruise is interrupted. It also covers you for any medical emergencies and baggage loss.